- This is a redesign of the SuperTrend indicator. It removes stupid transitions between SuperTrend states and highlights initial points for both lines. SuperTrend is a.

- Look for Supertrend down, wait for stochastic to go past 80 (overbought) and price to make action as if it is going to cross down again. So there are two ideas on how to get started trend trading or scalping forex with Supertrend. Of course, you’ll need to do some training in order to use the Supertrend Indicator effectively.

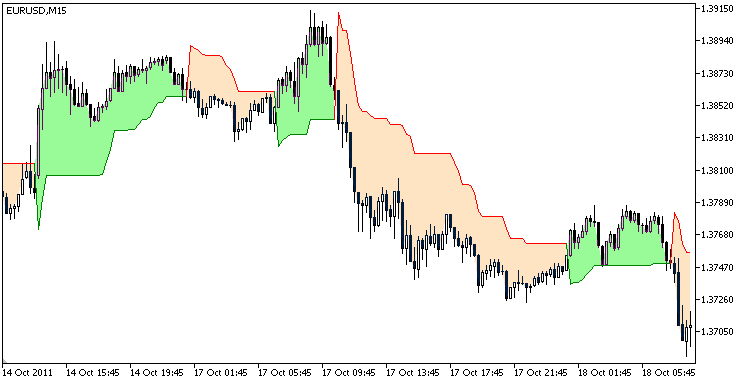

- Supertrend is the trend following indicator. It’s used to tell you the trend of the share. Supertrend line is plotted on the candlesticks of the share price. The green line indicates a bullish trend and the red line indicate the bearish trend.

- Supertrend Indicator Mt4

- Supertrend Indicator Mt4 Free Download

- Supertrend Indicator On Tradingview

- Supertrend Indicator Mobius

- Supertrend Indicator Download

- Supertrend Indicator Ninjatrader 8

Dear friend,

The SuperTrend U11 is a stop and reverse (SAR) indicator that trails price action. The trailing stop adjusts to both trading prices and volatility. When volatility is high, the trailing stop is further away from prices. Conversely, when volatility is low, the trailing stop will move closer to prices.

I hope you're sitting down.

Because this is a fascinating story about the rise of fame of the most amazing (in my opinion) trend indicator of all time.

And how today will go down in history as the date this astonishing indicator gets 3X better. With increased accuracy, increased usefulness, and more...

You see...

The indicator I'm talking about is called Super Trend. And you know why tens of thousands of traders - from forex to stocks to futures - consider it the #1 trend indicator of all time?

Because it kicks ass. Yes, it really does: Super Trend lets you ride the trend to the very end for easy, easy profits. Thanks to its ingenious algorithm that literally forces you NOT to exit prematurely.

But...

I believe we can make Super Trend even better. You see, the traditional Super Trend indicator uses the standard Moving Average as its backbone.

And while the standard Moving Average is useful, it's also LAGGING (and even severely lagging under certain market conditions).

That's why we set out to completely overhaul the Super Trend indicator.

Our goals: Increased accuracy, increased versatility, and most importantly, LESS LAG.

Now, 3 months later, I'm super excited to announce: WE DID IT.

Introducing our brand-new, amazing:

Versatile Super Trend indicator

This indicator is incredible. Check this out:

+ The Versatile Super Trend indicator lets you define a CUSTOM Moving Average to use in its core engine. You can choose from 10 different types of Moving Average.

Simple Moving Average (SMA),

Exponential Moving Average (EMA),

Smoothed Moving Average (SMMA),

Linear Weighted Moving Average (LWMA),

Exponential Moving Average (DEMA)

Triple Exponential Moving Average (TEMA),

Kaufman's Adaptive Moving Average (KAMA),

Jurik's Moving Average (JMA)

Hull Moving Average (HMA)

Least Squares Moving Average (LSMA)

Tillson Moving Average (T3)

Just WOW, isn't it?

+ The Versatile Super Trend indicator gives you an alert immediately when it detects a new trend:

Pop-up notification in your MT4.

PUSH notification.

Email notification.

Now, let's see the Versatile Super Trend indicator in action (using different types of Moving Average):

Versatile Super Trend (with Tillson Moving Average)

Know everything about Supertrend Indicator here. It is commonly used Intraday Indicator & is quite similar to moving averages.

Find details about its meaning, how it works, its calculation, its parameters & more.

About SuperTrend Indicator

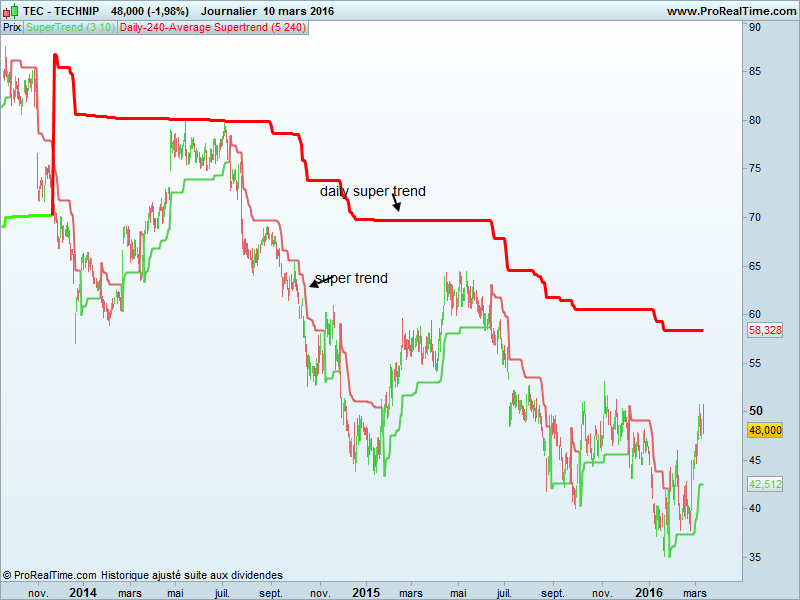

The super trend is similar to moving averages as it follows moving averages. The best part about using this indicator is that it can be used on several time frames at a time.

You can place it on a more oversized time frame and then choose to move down to the lower timeframe and use the same as signals for entry and exit.

The majority of the time, the indicator provides correct signals. Additionally, you can find the indicator on different platforms and that too without paying anything.

One of the most common dilemmas of intraday traders is what indicator can be used to intraday trades.

If you are an intraday trader, then most likely, it is possible that you might use technical analysis to evaluate trades based on different parameters.

The one indicator that we have at the back of our mind is the SuperTrend indicator, as it is quite simple to learn and implement.

History of Supertrend Indicator

You might be curious to learn about the SuperTrend indicator. Olivier Seban had invented this indicator.

The indicator is more like moving averages. It is mainly jotted on price, and its placement can ideally evaluate the existing trend on the price.

The indicator is straightforward and easy to understand and can be constructed with the help of only two parameters, including multiplayer and period.

When it comes to the construction of the SuperTrend indicator strategy, the general parameters are 10 for the Average True range.

One of the most critical trends that play a vital role in SuperTrend is the indicator uses ATR to evaluate its value and its signals the price voltality degree.

Open Demat Account in 10 Min & Start Trading Now!

How to use SuperTrend Indicator?

If you want to use this indicator, then you need to open a chart of a specific security that you want to keep an eye on and also set the interval time and even set 10 times as interval time while doing intraday trading.

Supertrend Indicator Mt4

You can choose any reliable charting software. Once you setup the chart, you can add a super trend and alter the settings between 10 and 3.

Additionally, you can also customize the settings as per your needs. Above all, you need to remember that you shouldn’t stop loss when you use this indicator.

No doubt, if you have a long position, you can choose to put the stop loss right at the green indicator signal.

On the other hand, when it is a short position red indicator signal is perfect for placing the stop loss.

One of the best ways to earn exceptional wealth in trading is by using a super trend besides the stop loss signal.

How to calculate the SuperTrend Indicator?

You can calculate the SuperTrend indicator with the formula given below:

Up = (high + low / 2 + multiplier x ATR

Down = (high + low) / 2 – multiplier x ATR

Average true range calculation:

[(Prior ATR x 13) + Current TR] / 14

Under this, 14 is nothing but the period. Thus, ATR is calculated by multiplying the last ATR by 13. All you need to do is add the most recent TR value and then divide it by the duration.

Lastly, you need to know that ATR plays a crucial role when it comes to the calculation of technical analysis indicators.

Parameters for the Supertrend Indicator

The period between 10 and 3 is usually one of the most common parameters. You can also term it as a default parameter.

You can see significant changes in the SuperTrend when there is even a minute alteration in these numbers.

Furthermore, you need to drill one thing in your head: there is no such thing as an exceptional setting for any trading indicator.

Supertrend Indicator Mt4 Free Download

Also, the greater the settings you alter, the better will be your system over-optimized for a specific period of time. Thus, you need to know some details like:

- An indicator can become more reactive with regards to price even when a minute setting is made. All it means is that you get more signals.

- The noise from the market is mainly eradicated from the market with higher settings. But there are also minimized risk trading signals.

Tips for using the SuperTrend Indicator

- Firstly, you need to open the chart of specific security you want to start trading in.

- If you are looking for intraday trading, then you need to set the time interval of 10 minutes. Above all, you can use any good charting software.

- Under your indicator, you can use any SuperTrend. Additionally, you can use settings at 10 and 3. Furthermore, settings can be altered as per your requirements.

- You can start keeping an eye when signals are in your court. All you need to do is follow the simple signs that tell you when you can buy and sell securities.

Supertrend Indicator On Tradingview

By using this indicator, you can evaluate the security in technical terms. Additionally, it works exceptionally in the trending market.

In any market, you can quickly know the uptrend and downtrend. It would be great if you put stop loss when you use this indicator.

Identifying Buy and Sell signals using SuperTrend

In trending markets, the SuperTrend indicator seems to work amazingly during both uptrends and downtrends.

You can quickly determine the buy or sell signal when, during the closing price, the indicator flips over.

When the indicator dips below the price and closes, it can be termed as a buying signal, and you can also see the green color on the chart.

While, when the indicator hits above the price and closes, it is known as the selling signal, and the charts turn red.

In the sideways markets, the indicator might also generate incorrect signals. Above all, you need to know that no single indicator is correct always.

You can also combine the SuperTrend indicators to get fantastic trading signals.

What are the Pros and Cons of using the SuperTrend?

List of Pros:

- It always tends to send out correct signals.

- The indicator is most likely to send signals at a definite time.

- When it comes to intraday traders, it offers quick technical analysis.

- It is also helps intraday traders to make better decisions.

List of Cons:

Supertrend Indicator Mobius

- The indicator isn’t perfect for all situations.

- It ideally works only if the market is trending.

- The indicator uses only two parameters, and in some cases, they aren’t enough to predict the correct market direction.

Supertrend Indicator Download

Conclusion: Supertrend Indicator

After learning so much about the SuperTrend Indicator, one can say that it can be used only when the market is trending, and also, there are precise uptrends and downtrends with regards to price.

When the market is moving sideways, the indicator doesn’t seem to be fruitful as it might also give faux signals, which leads to bad trades eventually.

Supertrend Indicator Ninjatrader 8

If you want to use this indicator in a practical way, then it is highly recommended that you use it combining with other indicators, including moving averages.

Open Demat Account in 10 Min & Start Trading Now!

Most Read Articles

| Top 10 Discount Brokers |

| Top 10 Full Service Brokers |

| Best Stock Broker in India |

| Top 10 Intraday Trading Brokers |

| Best Demat Account in India |

| Stock Broker Comparison |

| Top 10 Broking Franchise |

| Sub Broker Franchise |

| Mobile Trading Apps |